News You Can Use

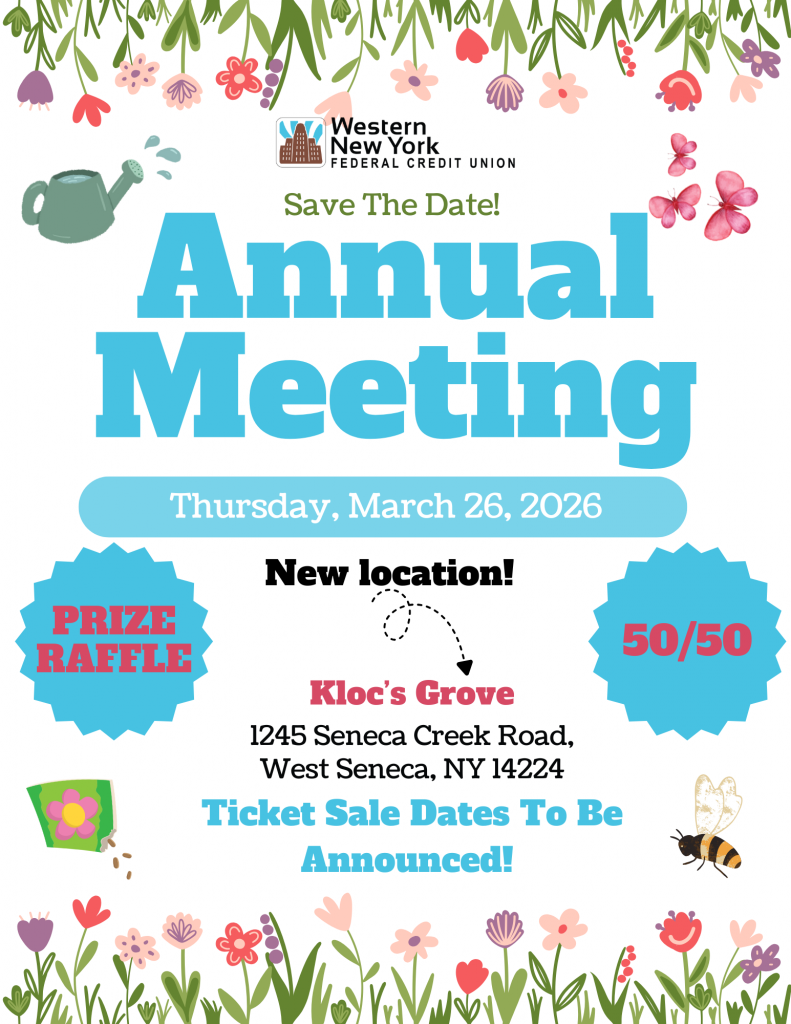

Save the date for our Annual Meeting!

Join us on Thursday, March 26th at Kloc’s Grove for our Annual Meeting!

Board of Directors Annual Election Notice

Western New York Federal Credit Union would like to notify the Membership of the process for nominating and voting for the Board of Directors at the 2025 Annual Meeting. This credit union’s grand success is largely due to our volunteers and their efforts. Our Board of Directors and Committee members are all dedicated volunteers, sharing their energy, talents and time.

Refer Your Friend!

Refer your friend to share your love for WNY Federal Credit Union and you and a friend could each win $300!